- Solution overview

Meeting unpredictability with confidence in the capital market environment

Third-party support can help banks manage changing regulations, evolving platforms, and new trading methods

When it comes to capital markets, ongoing volatility is here to stay. The past few years have proved that. So today's financial services firms must quickly adapt to an investment landscape that remains a moving target.

Staying up to speed in a shifting capital market world

Under this new scenario, trading approaches are constantly evolving. Regulatory initiatives are rapidly shifting to involve greater scrutiny of digital processes and governance protocols. And the rules surrounding post-trade processes are especially fluid, varying from month to month and geography to geography. These changes can drive up the cost of compliance and put more pressure than ever on firms to navigate ongoing developments in real time and in a cost-efficient manner. Too often, however, several factors make meeting these urgent demands difficult. Corporations may have decentralized middle and back offices that simply aren't up to today's rigorous requirements. Their trading architecture is often outdated, ill-equipped, or too poorly supported to handle multiple platforms. They may not have the in-house operational expertise to keep expenses in check and scale their businesses. So they may also be grappling with finding a right-shoring model that best serves their needs.

Take a copy for yourself

An ally with a depth of experience

A strategic alliance is an effective way not only to meet these challenges but to propel a business to the next level. Genpact is offering that kind of partnership. Our proposition is unique – a people-process-technology approach that boosts the impact of all three to deliver a cohesive, optimal outcome.

Since the inception of Genpact's capital markets practice, we've carried out more than 20 implementations for top global investment banks, helping them tap into our full-service suite of tools and consulting expertise and take full advantage of our experience developing and maintaining advances in trading platform technologies. On the micro level, they trust our deep experience with the technical intricacies of multiple trading platforms. On the macro level, they count on us to help formulate a big-picture, holistic strategy that always keeps business goals firmly in focus.

And by optimizing front-, middle-, and back-office functions, we have helped them enhance the trade cycle for derivatives, asset-backed securities, and other products at every stage, from sales and initiation to operations and accounting.

Genpact's comprehensive approach

- Front-, middle-, and back-office operations: We unify and integrate processes across all regions for a prompt and cost-effective response to regulatory changes

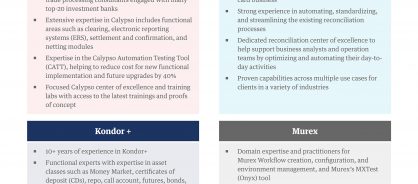

- Multiple platforms: When it comes to capital markets platforms, we are always one step ahead of upgrades, migrations, and handovers. Our experts are constantly upskilling themselves through our dedicated training academy, Genome, and various certification programs, such as the National Stock Exchange (NSE) Academy Certification in Financial Markets, Financial Risk Management (FRM), and Chartered Financial Analyst (CFA) programs. We can act on changes to these platforms immediately, no matter which – or how many of them – you use. Our strong relationships with all the major trading platform vendors form the foundation of our platform expertise. The table below illustrates our direct partnership and capabilities with Calypso and a robust ecosystem of other providers, including Murex, Finastra, Kondor+, and IntelliMatch

Figure 1

- Center of excellence (CoE) for trading platforms: our CoE is another reflection of our powerful alliance with platform vendors. We create a comprehensive and exhaustive reference library with complete documentation that covers all platform software, which updates in real time. We've customized our risk assessment toolkit according to asset class. Our reusable testing capabilities and accelerators reduce time to market when there are software changes or enhancements. And we provide 24/7 support through artificial intelligence, bots, and expert personnel

- Training: through the CoE, we mitigate the technology, architecture, performance, and legal risks associated with upgrading, migrating, and handovers. We conduct training and knowledge exchange sessions on a regular basis to bring all relevant stakeholders up to speed on these changes.

- Right-shoring: we set up a model that provides the ideal combination of cost and efficiency by finding people with the right talents in locations that offer the best value. We establish and monitor governance and compliance protocols across the network and link everyone using the latest technology. We support and maintain both offshore and onshore work

Figure 2

Case study

A Calypso upgrade for a major bank

A French financial services institution with operations in 23 countries struggled with a dated and disjointed Calypso trading platform. There was no consistency in clearing, settlement, invoicing, and accounting functions across geographies.

Genpact rolled out an upgrade of Calypso from version 9 to version 16. The new version handled multiple asset classes and integrated all functions, making them consistent everywhere. We also provided regression testing and 24/7 functional support. The bank soon saw a 20% reduction in operations costs, a 30% drop in support tickets, and a 20% drop in system testing costs.